Tour Operator (hereinafter referred as Service Provider) provides services to the ultimate consumers (Recipient) through various counterparts such as the Airline companies, local taxi operators, hotel, embassy issuing visas and many other services. The major sources of Income for Tour Operators are:

1. Domestic/ International Hotel Bookings

2. Air Ticket & Commission from Airlines Companies

3. Sale Tour Packages

4. Travel Related Services like Visa, Passport, etc.

5. Railway Reservations

6. Car Rental Services, Travel Insurance

With reference to the provisions of the Central Goods and Services Act, 2017 (“CGST”) and Integrated Goods and Services Tax Act, 2017 (“IGST”) services made by travel agents are analyzed through the consequent framework:

Definitions

“Tour agents” or “Tour operator” means any person engaged in the business of planning, scheduling, organizing, arranging tours (which may include arrangements for accommodation, sight-seeing or other similar services) by any mode of transport and includes any person engaged in the business of operating tours”.

An Overview

1. Domestic/International Hotel Bookings:

A. In case of domestic hotel booking Tour, operator is acting as an intermediary for the purpose of booking tours and hence Place of supply will be the Location of Hotel.

B. In the case of international booking Place of supply shall be location of agent.

Place of supply:

> When Agent receives commission from Hotel/ Cruise:

| Location of Agent | Location of Hotel/Cruise | Place of supply of Travel Agent | Tax to be charged |

| Chennai | Delhi | Delhi | IGST |

| Chennai | Bangalore | Bangalore | IGST |

| Chennai | London | Chennai | CGST+IGST |

> When Agent receives commission from the recipient:

| Location of the Agent | Recipients’ Regist-ration Status | Location of the recipient | Location of the hotel/ cruise | Place of Supply for the agent | Tax to be charged |

| Chennai | REG | Mumbai | Delhi | Mumbai | IGST |

| Chennai | REG | Delhi | Gujarat | Delhi | IGST |

| Chennai | REG | Kolkata | Thailand | Kolkata | IGST |

| Chennai | UNREG | Singapore | Pune | Pune | IGST |

2. Air Ticket & Commission from Airlines Companies

A. Air travel agents are required to pay 18% GST on commission earned from airlines and also service charges, handling charges etc. (by whatever name called) collected from the customers/ passengers.

B. Air travel agents can avail ITC on input services to support the output services of travel agents.

C. As an alternative to GST payment in the above manner, rule 32 (3) of CGST rules, 2017 permits an air travel agent to discharge GST at fixed percentage of basic fare on which commission is normally paid by the airlines to the agent

Place of supply of service:

> In case travel agent receives processing fees/ service charges from passengers place of supply of Air travel agent Location of recipient weather or not the recipient is registered or not.

> In case travel agent receives commission from airlines place of supply of Air travel agent Location of airlines.

| Location of air travel agent | Location of the airlines | POS for air travel agent | Tax to be charged |

| Chennai | Delhi | Delhi | IGST |

| Chennai | Mumbai | Mumbai | IGST |

| Chennai | London | Chennai | CGST+SGST |

3. Sale of Tour Packages

A. Both Service provider and Recipient in India:

B. Either of them outside India:

1. Tours organized by the tour operator, within India for the tourist coming from abroad is generally known as inbound tours.

2. Tours organised by the tour operators, outside India for the tourist going abroad is generally known as outbound tours.

4. Travel Related Services like VISA, Passport, etc.

A. VISA processing charges charged by visa statutory authorities will be exempt from GST.

B. If visa/ passport is obtained from Visa Facilitation Centers (VFCs) then the same shall be liable to tax.

C. However, when Air travel agent provides these services to their clients after adding further fees, he shall be liable to pay tax on them as well he can take ITC of the tax paid to VFC.

D. GST will be applicable at 18% for the services provided by Air travel agent.

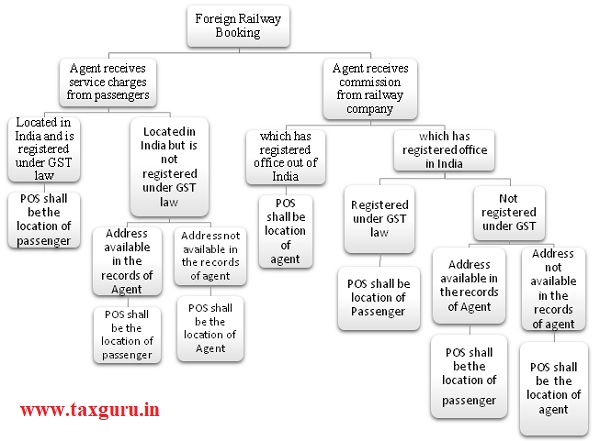

5. Railway Reservations

A. Rail travel agent are required to pay 18% GST on service charges collected from passengers.

B. SAC for Rail travel agent is 9967.

6. Car Rental Services

GST applicable for renting motor vehicle shall be at 5% without ITC or at 12% with ITC.